The Petersburg Borough has lost sales tax revenue this year due to the pandemic like many other municipalities across Alaska. As Angela Denning reports, a new program that collects sales tax from online vendors is helping to make up some of the difference.

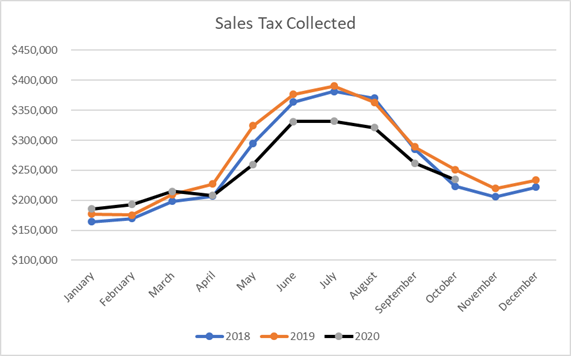

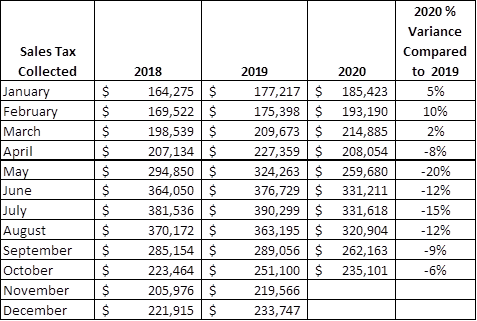

Ideally, every community would see small increases in sales tax to meet inflation. But that didn’t happen this year. The Petersburg Borough is down nine percent in sales tax revenue as of mid-December. A nine percent loss equals about $242,000. It might not sound like a lot but for a small town, it is.

“Everything was staying about the same month to month until we reached April,” said Jody Tow, the borough’s finance director. She says revenue dropped when the pandemic hit. “Charter and travel is down 80 percent, hotel and lodging is down about 30 percent, restaurants are down 15 percent on average.”

The worst month was May when sales tax revenue was down 20 percent. That’s a difference of nearly $65,000 from last year.

But it could be a lot worse.

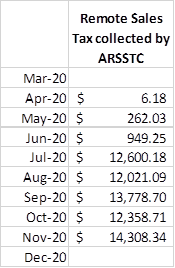

Sales tax losses started shrinking dramatically by this fall. That’s because a new remote sales tax program is helping to even things out. For example, in October, there was a six percent loss in local sales tax but $16,000 in online sales tax made up more than the difference.

The online tax collection took off in July when Petersburg signed up for the Alaska Remote Sellers Sales Tax Commission. It’s a non-profit program run through the Alaska Municipal League. AML created the program following a 2018 ruling by the U.S. Supreme Court that allows states to collect taxes on out-of-state sales regardless of whether a company has a physical presence in that locale. For a fee, Tow says, the commission collects tax from online sales to Petersburg residents from vendors that are not physically present in town.

“It’s well worth having someone else do it,” said Tow. “We couldn’t do it ourselves.”

Municipalities across Alaska are signing up for the program. It’s estimated to bring about $9 million in revenue this year.

“It has been successful. So far we’ve had 33 municipalities across the state join,” said Clinton Singletary, Alaska Municipal’s Sales Tax Director. “We’ve got eight more who are working towards fully participating so I mean, we’ve still got a ways to go. There’s over a hundred municipalities in the state that could participate but we’ve seen good growth in the first year.”

For Petersburg, remote sales tax has brought in about $66,000 so far, averaging about $13,000 per month. That monthly income is expected to rise in the future as more and more online retailers become part of the program. There are over 750 vendors so far.

“They keep adding new vendors every month,” said Tow. “They just added Target, which is a big one so it will be interesting to see how much the numbers grow in the future.”

In theory, they should grow but it’s not a guarantee. It could be that more residents are shopping online due to the pandemic and eventually, the online sales will drop. Only time will tell.

“Maybe these numbers right now that are coming in are higher than they might be,” Tow said. “You know, it’s hard to tell but as vendors keep joining the commission I think that we can be hopeful that the numbers will grow.”

If the trend does continue then the borough would bring in about $156,000 in remote sales tax a year.

And it could mean $10 million annually for Alaska’s remote communities.